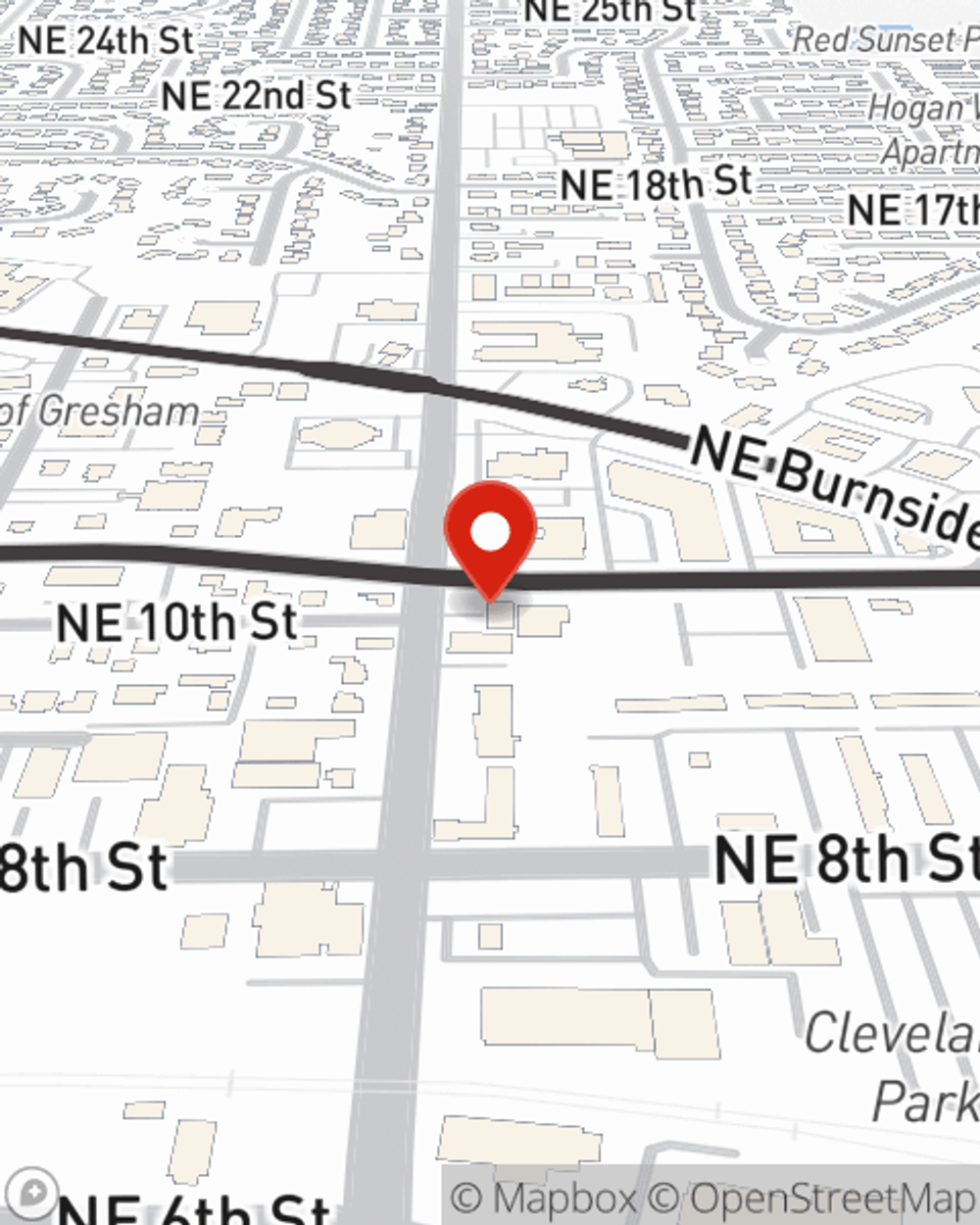

Business Insurance in and around Gresham

One of the top small business insurance companies in Gresham, and beyond.

Insure your business, intentionally

Coverage With State Farm Can Help Your Small Business.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, extra liability coverage and a surety or fidelity bond, you can feel comfortable that your small business is properly protected.

One of the top small business insurance companies in Gresham, and beyond.

Insure your business, intentionally

Keep Your Business Secure

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Joe Swift for a policy that covers your business. Your coverage can include everything from business continuity plans or errors and omissions liability to key employee insurance or group life insurance if there are 5 or more employees.

Reach out agent Joe Swift to consider your small business coverage options today.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Joe Swift

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.